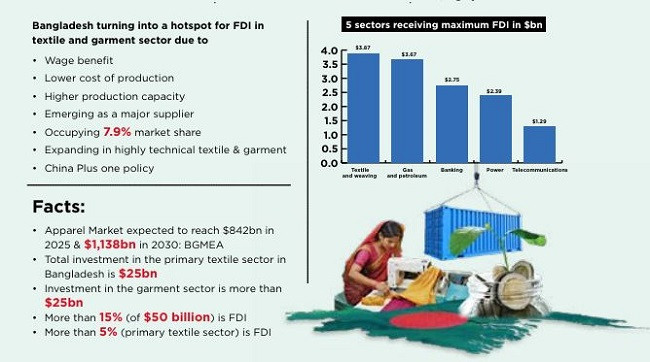

Bangladesh has been turning into a hotspot for foreign investment in the textile and garment sector as the competing countries are losing the appetite in this trade.

China being the largest apparel supplier worldwide is losing its pie in apparel trade mainly because of two reasons including the dearth of skilled workers in the sector and for higher cost of production.

Moreover, the countries like Japan and Germany those which have invested in China earlier, are also pulling back their investment from this country as they have already adopted the China Plus one policy.

Under the China Plus one policy, the investors of many other countries are investing in textile and garment in the countries like Bangladesh, Vietnam, India, Indonesia, Thailand and Cambodia.

Bangladesh has been becoming an attractive destination because of wage benefit and for lower cost of production compared with other countries.

Also because of higher production capacity of textile and garment in Bangladesh, the international clothing investors are preferring this country for their valuable investment decision.

Because, Bangladesh has emerged as a major supplier of textile and garment in the global supply chain occupying 7.9 percent market share and Bangladesh Garment Manufacturers and Exporters Association (BGMEA) wants to occupy 10 percent of global garment share and by 2030 the local apparel exporters want to export $100 billion worth of garment items from $46.99 billion in the fiscal 2022-23.

The ambition for exporting of $100 billion by 2030 has opened the gate of opportunity for the investment in the textile and garment sectors both by the local and international entrepreneurs.

Because, if Bangladesh wants to achieve the target by this time or beyond 2030 the country needs to diversify the fibre, fabrics and finished products garment items.

For instance, the local garment exporters are emphasising more on man-made fibre along with the cotton fibre for grabbing more opportunity in trade.

Recently, the foreign direct investment (FDI) has also been taking place in this man-made fibre, highly technical textile and garment sector to meet the demand for garment exporters.

The local textile millers are also expanding their capacity in the highly technical textile and garment industry.

Currently, many entrepreneurs of different countries are investing in Bangladeshi textile and garment industry as they are losing their market share in China.

FDI status in textile and garment sectors

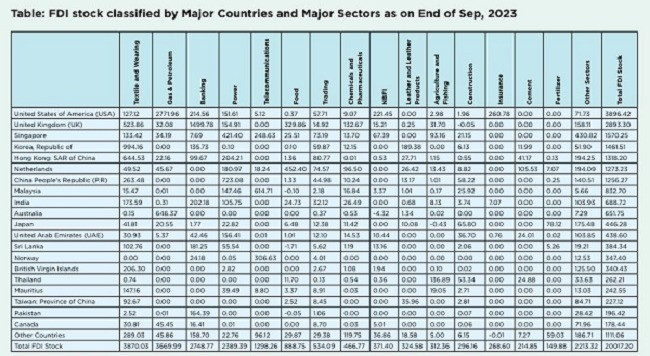

As of September 2023, the stock of FDI in textile and weaving reached at $3870.03 million, according to data from the Bangladesh Bank (BB).

Of the total invested money, South Korea is the highest investing country in this segment.

The South Korean investment in textile weaving stood at $994.16 million, China, being the second highest invested $644.53 million, the third is the UK and invested amount is $523.86 million, the USA invested $127.12 million, Singapore at $133.42 million, India at $173.59 million, the BB data also said.

The FDI inflow in textile and weaving sectors is higher than the other sectors as the opportunity in Bangladesh has been growing.

For instance, as of September last year, the FDI inflow in the gas and petroleum was $3669.99 million, banking sector was $2748.77 million, power at $2389.39 million, telecommunications at $1298.26 million, food at $888.75 million, trading at $534.09 million, chemicals and pharmaceuticals at $466.77 million and Non-Banking Financial Institute (NBFI) at $371.40 million.

Leather and leather products at $324.58 million, agriculture and fishing at $312.36 million, construction at $296.16 million, insurance at 268.60 million, cement at $214.85 million, fertilizer at $149.88 million and other sectors at $2213.32 million, the BB data also said.

The global apparel market is expected to reach $842 billion in 2025 and $1,138 billion in 2030, the BGMEA said recently.

The total investment in the primary textile sector in Bangladesh which include spinning, weaving, dyeing, finishing, washing and printing is nearly $25 billion and investment in the garment sector is more than $25 billion.

Of the amount both in textile and garment ($50 billion), more than 15 percent is FDI which indicates that more foreign fund is needed in this sector.

The FDI in the primary textile sector in Bangladesh is more than 5 percent, said Monsoor Ahmed, additional secretary to Bangladesh Textile Mills Association (BTMA).

Why the FDI is needed in textile and garment

Capacity improvement is the main target for investment both by the local and international investors. Currently, the capacity in the primary textile sector is more than 20 million spindle and the entrepreneurs are expanding the capacity gradually, according to data from BTMA.

The country needs more investment in technical textile and garment sectors where the foreign investors can come with their investment proposals. But, recently the textile and garment production of Bangladesh have been shifting to more man-made fibre items.

Currently, of the total exported garment items from the country, 29 percent is made from the man-made fibre and 71 percent is made from cotton made fibre, according to data from the BGMEA.

Even three years ago, the proportion of the man-made fibre garment was 24 percent and now it reached to 29 percent because of higher demand for the man-made fibre from the garment exporters.

The FDI can also transfer the knowhow for the local entrepreneurs on which they can flourish the sector.

Sector leaders’ opinion

Immediate past BGMEA President Faruque Hassan said Bangladesh needs FDI in specialised garment items where Bangladesh has not so much capacity as the local exporters are strong in production of the basic garment items.

For instance, the FDI may be attracted in production of suits, lingerie, workwear, outerwear and swimwear, Hassan said. The FDI may also be attracted in the production of primary textile sector in specialised areas, he added.

Vice-president of BTMA Md. Fazlul Haque, said with the beginning of the Covid-19 and the Russia Ukraine war the inflow of investment both from the domestic sources and FDI slowed down significantly in the primary textile sector because of continuous volatility in the global supply chain.

Haque also said the time when the local entrepreneurs are not investing, then the FDI inflow cannot be expected in this sector. Because, the inflow of the domestic investment indicates the opportunity of investment also by the foreign entrepreneurs, he added.

Inadequate supply of gas and power along with the volatile global supply chain in the post-Covid-19 era and for the severe fallouts of the Russia Ukraine war are mainly responsible for the slowed investment inflow in the sector, the BTMA vice-president also said.

Haque also echoed with the views of Hassan. He also said the FDI in textile sector may be attracted in the specialised textile sector where Bangladesh is lagging behind.

Concluding remarks

Bangladesh is going to be graduated to a developing nation by November 2026 from the Least Developed Country (LDC). Once the country is graduated, Bangladesh may lose trade worth $8.0 billion because of erosion of trade preference due to LDC graduation.

Moreover, the main export garment items will no longer enjoy the duty benefit and the local exporters will have to face tough competition from their international competitors.

During the time of intensified competition, the local exporters will have to have diversified fibre and products so they can compete globally.

The production and sale of high-end garment items may make them competitive. Here the foreign investment is needed also because of technology transfer and technical knowhow.

The government should create a very good business environment removing the trade barriers so the FDI comes easily in the textile and garment sectors.